Anyone who has shopped for car insurance knows there are a ton of companies to choose from these days. If you’re in that situation right now and you’re feeling overwhelmed, start at the top. In other words, start your search with the largest car insurance companies in the U.S.

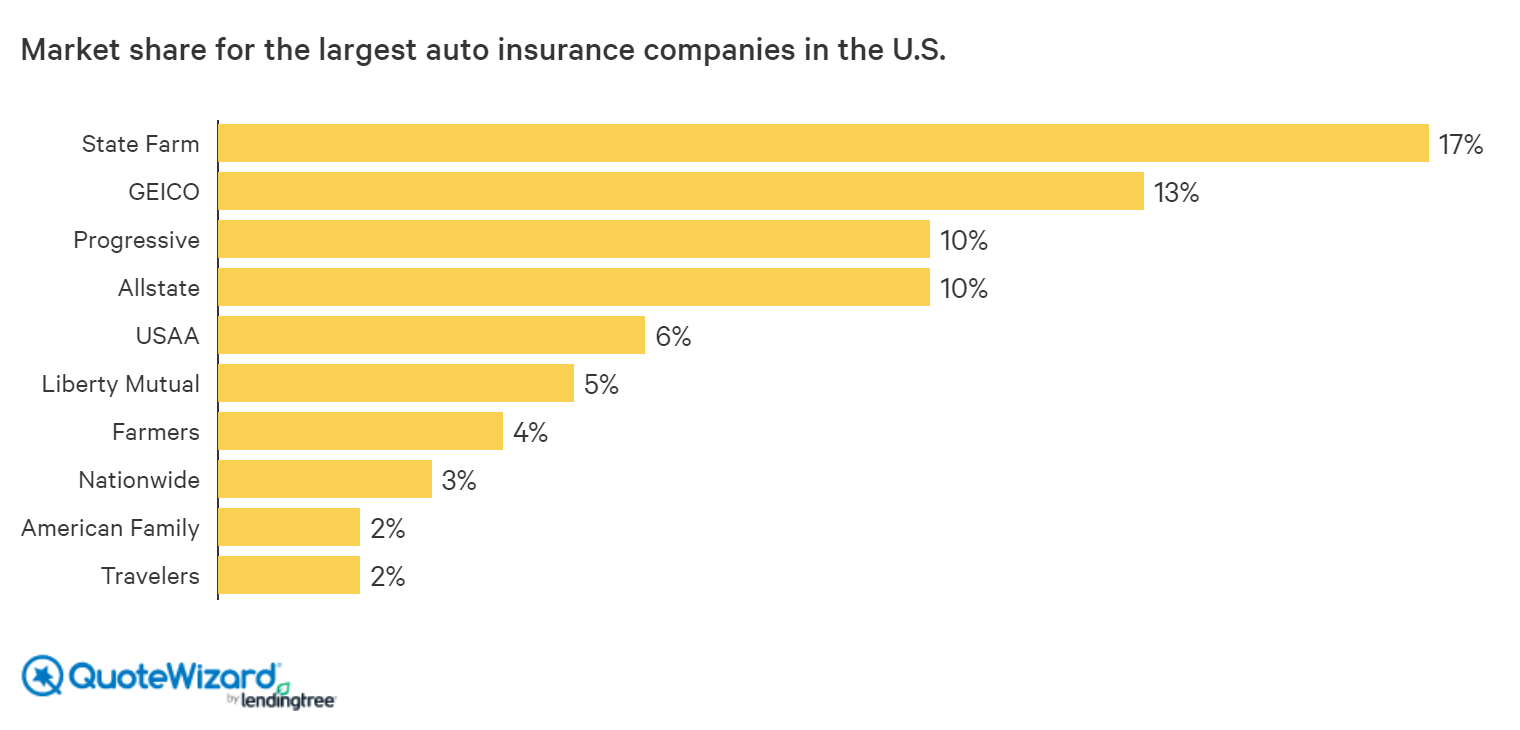

Finding a good option won’t be difficult. The 10 largest insurance companies in the auto space currently control about 72% of the market, as the table below shows. Chances are, many of them serve the state you call home.

How can you narrow down your choices from there? Check out the information we’ve compiled in this article. It will help you learn more about the biggest auto insurance companies in the country and should help you decide between them, too.

|

|

Company | Market share |

|---|---|---|

| 1 | State Farm | 17% |

| 2 | GEICO | 13% |

| 3 | Progresive | 10% |

| 4 | Allstate | 10% |

| 5 | USAA | 6% |

| 6 | Liberty Mutual | 5% |

| 7 | Farmers | 4% |

| 8 | Nationwide | 3% |

| 9 | American Family | 2% |

| 10 | Travelers | 2% |

| Source: S&P Global Market Intelligence | ||

Why choose a large car insurance company?

Although small car insurance companies often provide a better customer experience than their bigger competitors, large car insurance companies compensate for it in several areas.

A prime example is that the largest car insurance providers tend to outperform small ones in terms of coverage options, discounts and even representative availability. Another is that it’s often easier to bundle policies when you get them from a large insurer.

And then there’s the fact that the big, nationwide brands in the car insurance industry are more financially stable than regional or local brands with less visibility.

Which of these insurance providers should you approach while shopping for auto coverage? That depends on a number of factors, like where you live, your driving record, your credit score and more. To find the best car insurance companies for your situation, compare quotes from several companies before buying a policy.

1. State Farm

State Farm is the largest car insurance company in the U.S., commanding 17% of the market. It sells policies in every state except Massachusetts and Rhode Island, so chances are it's an option where you live.

Other things that help State Farm stand out from its competitors:

- It has nearly 19,000 agents and 58,000 employees.

- It has almost 44 million auto insurance policies in force in the U.S.

- It offers extensive insurance coverage for rideshare drivers, business travelers, collectors and more.

- It offers a bunch of discounts, too, like an accident-free discount, an anti-theft discount and a multi-line discount.

2. GEICO

GEICO is the country’s second-largest car insurance company. It sells auto coverage in all 50 states as well as Washington, D.C., and it owns 13% of the market.

Some of GEICO’s claims to fame in the car insurance space:

- It’s been a wholly owned subsidiary of Berkshire Hathaway since 1996.

- It employs over 30,000 agents.

- It insures more than 28 million vehicles.

- It has an A++ (the highest possible) financial strength rating with AM Best, plus Aa1 and AA+ ratings from Moody's and Standard and Poor's, respectively.

3. Progressive

As the third-largest auto insurer, Progressive controls nearly 10% of the car insurance market in the U.S.

Progressive has over 33,000 employees and more than 22 million policies in force. Why might you choose it over the other insurance companies highlighted here? A few possibilities:

- It offers auto insurance in all states and Washington, D.C.

- It provides customers unique savings options like the Name Your Price Tool, which lets you choose the best coverages for your budget, and Snapshot, a telematics device.

- It claims 99% of its policyholders earn at least one of its discounts, which are aimed at teen drivers, people who have more than one vehicle or policy, and those who agree to go paperless, among others.

4. Allstate

Allstate also has nearly 10% of the auto insurance market, putting it among the top five largest insurance companies in the nation.

This Northbrook, Ill.-based insurer works with approximately 12,000 exclusive agents nationwide. It also:

- Has 113 million policies in force

- Offers attractive add-ons like accident forgiveness, several discounts, and rewards for safe driving that can be redeemed for products

- Sells specialty policies that cover classic cars as well as trips to Mexico

5. USAA

USAA being the fifth-largest car insurance company is an impressive feat, especially when you consider only members of the military and their families can buy coverage from it. They're consistently recognized as the best car insurer for military members.

Nearly as impressive:

- It boasts a 6% market share.

- It serves 12.8 million members.

- It retains more than 97% of those members.

Also, those who qualify for USAA membership enjoy discounted auto insurance rates and excellent customer service.

6. Liberty Mutual

Liberty Mutual, sixth among the largest car insurance companies in the U.S., holds about 5% of the market. It offers a wide range of insurance coverage types beyond auto, including home, condo and renters insurance.

Speaking of which, if you have more than one policy with Liberty Mutual, you’ll get a discount. The Boston-based insurer also gives discounts to:

- Drivers with no accidents or violations on their records

- Early shoppers

- Good students

- Military members

7. Farmers

Farmers is the country’s seventh-largest auto insurance company, with a market share of around 4%.

Although it originally insured just rural farmers, the Woodland Hills, Calif.-headquartered insurer now sells coverage to eligible drivers in all 50 states. And it assists those drivers with the help of over 48,000 exclusive and independent agents.

Thanks to that change in focus, Farmers:

- Has more than 19 million individual policies in force

- Serves more than 10 million households

Those 10 million households seem pretty happy with Farmers, too. After all, it has an A+ rating with the Better Business Bureau (BBB), with which it has been accredited since 1951.

8. Nationwide

Nationwide, the eighth-largest car insurance company in the U.S., represents approximately 3% of the market.

If you’re looking for more than just liability, collision and comprehensive auto insurance products, Nationwide has you covered. Not only does it offer gap coverage as well as towing and labor coverage, but it offers these optional coverages, too:

- Accident forgiveness

- Roadside assistance

- Vanishing deductible

Drivers interested in pay-per-mile insurance may want to consider SmartMiles, Nationwide’s usage-based program.

9. American Family

American Family is ninth among the largest car insurance companies in the nation. It covers just over 2% of the market.

The Madison, Wis.-based American Family employs 2,400 independent contractor agents who sell auto insurance policies to drivers in 19 states.

Those agents offer more than basic car insurance products to customers. They also offer:

- Roadside assistance

- Antique and classic car coverage

- Rideshare insurance

Finally, American Family is a mutual insurance company. That means it’s owned by policyholders rather than stockholders.

10. Travelers

Travelers is the 10th largest auto insurance company in the country, with a market share of around 2%.

It punches above its weight, though, by:

- Serving not only the U.S., but Canada, Ireland and the United Kingdom, too

- Working with 13,500 independent agents and brokers

- Being one of the oldest insurance companies around (it first opened its doors over 160 years ago)

Travelers also boasts an A+ rating with the BBB and the following financial strength ratings: A++ with AM Best, Aa2 with Moody’s and AA with Standard and Poor's.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.