Progressive Insurance Review

If you want cheap car insurance — and you’d prefer to get home, renters or auto insurance from a well-known company — consider Progressive. Not only does Progressive offer lower rates than many of its competitors, but it also offers a multitude of discounts that might make your policy’s premium even cheaper.

Products Reviewed

Best if

- You’re looking for affordable auto insurance, but it doesn’t have to be the absolute cheapest.

- You qualify for more than one of Progressive’s many discounts.

- You have a DUI or accident on your driving record but still want cheap car insurance.

Worst if

- You want to manage your policies and file claims through one insurer.

- If you’re looking for the cheapest rates. However, your rates may vary depending on your location and coverage needs.

- You want the cheapest auto insurance around and won’t settle for anything less.

- You’re a teen driver and you can’t afford high car insurance premiums.

Auto Insurance

Auto insurance at a glance

Offers several types of coverage, including gap, rideshare and rental car reimbursement.

Provides many ways to lower your premium, including a usage-based insurance program and a slew of discounts.

Progressive’s Name Your Price tool shows you coverage options that fit your desired price range.

Along with standard types of car insurance coverage, like liability, collision and comprehensive, Progressive offers several supplementary coverage types, such as:

- Uninsured and underinsured motorist coverage

- Medical payments coverage

- Gap insurance

- Rental car reimbursement

- Roadside assistance

- Rideshare coverage

Progressive also offers many car insurance discounts that may help lower your premium.

Even without discounts, Progressive is one of the cheapest car insurance providers around. Especially if you compare its average rates to those of other popular brands like GEICO and Allstate.

In addition, Progressive is one of the cheaper options when it comes to getting car insurance after an accident or DUI. Progressive's rates are not so cheap, however, if you are a teen driver.

Progressive is the third-largest insurance company in the U.S., based on 2020 data from the National Association of Insurance Commissioners (NAIC). It commands 5.75% of the market and has written just over 41.7 million direct property and casualty premiums.

How much is Progressive car insurance?

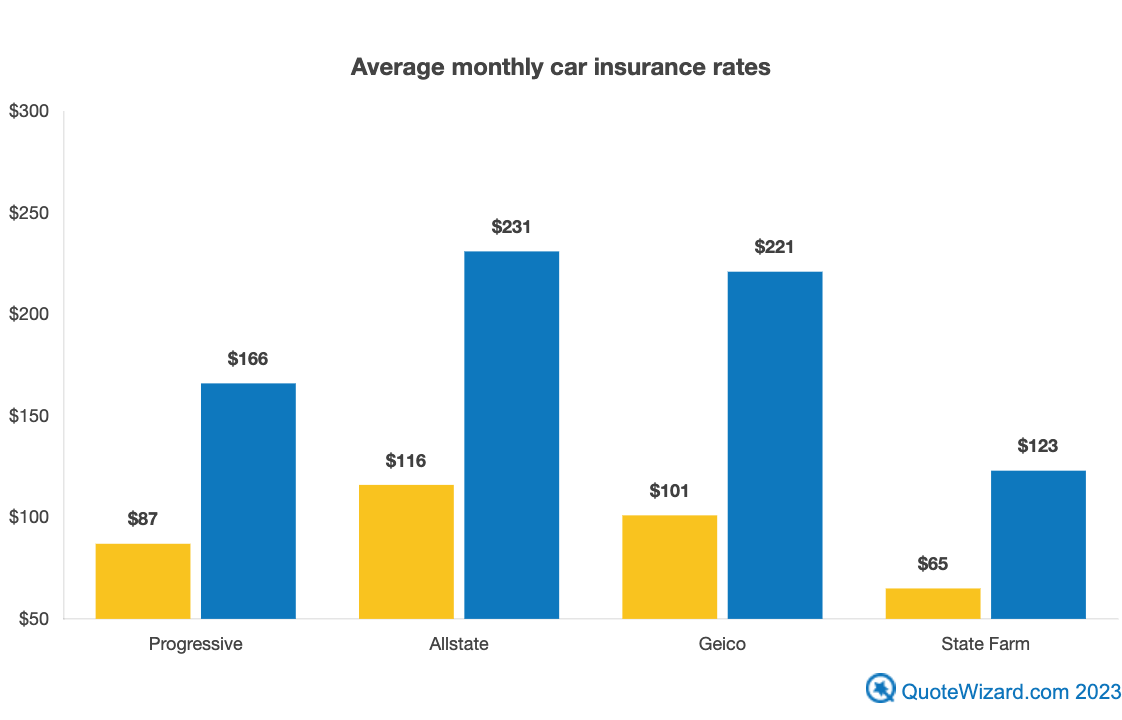

Progressive car insurance costs $87 per month, on average, if you only want the minimum amount of coverage your state requires. Full-coverage car insurance from Progressive costs an average of $166 per month, with this type of policy including liability, collision and comprehensive coverages.

These rates are on par with national averages for such car insurance policies, which are $87 per month and $177 per month, respectively. And they're lower than most of Progressive's main competitors, like Allstate and GEICO.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

Progressive car insurance rates are lower than those of Allstate and GEICO if you have incidents like accidents or DUIs on your driving record, too. The average quote Progressive sent our sample driver with a DUI was $218 per month for full coverage. That's more than $200 per month less than what GEICO and Allstate offered.

Progressive might not be the best company for cheap car insurance if you are a teen or young driver, though. The quotes it sent our sample driver were quite a bit higher than the ones competitors like State Farm, GEICO and Allstate sent.

That said, the older you are, the cheaper and more competitive Progressive's car insurance rates are likely to be. In fact, Progressive offered our sample 20-year-old driver cheaper rates than Allstate and GEICO, though they weren't as cheap as State Farm.

Which types of car insurance does Progressive offer?

Progressive offers liability, collision and comprehensive car insurance coverages. It also offers these additional coverage types:

Progressive auto insurance discounts

You can save a lot of money if you qualify for Progressive's many discounts, such as ones for multiple cars, multiple policies and safe drivers.

Progressive customer service ratings

Progressive has above-average customer service ratings from the Better Business Bureau (BBB) and the NAIC, and a below-average rating from J.D. Power.

The J.D. Power 2020 Auto Claims Satisfaction Study rating is based on a 1,000-point scale. The industry average is 872, with higher numbers being better than lower ones.

NAIC's Complaint Index measures customer complaints based on the rate of formal complaints filed to state regulators. The national median Complaint Index is 1.0.

How to pay your bill with Progressive

Progressive offers several bill pay options. You can pay your Progressive bill online, by mail, by phone or by text.

To pay your bill by phone, call (800) 776-4737.

Progressive offers an automatic payment option, too.

How to file a claim with Progressive

You can file a claim with Progressive through its mobile app, online or by phone.

To file a claim with Progressive by phone, call (800) 776-4737.

You can track your claim by logging into Progressive's website or app.

Home Insurance

Progressive doesn't underwrite home insurance policies. Instead, it offers quotes from multiple home insurance providers. You could get a bundling discount if you have Progressive auto insurance and buy home insurance from one of its affiliates. However, if you're looking for the cheapest home insurance rates, Progressive may not be the best option for you.

Progressive home insurance reviews

In its 2020 U.S. Home Insurance Study, J.D. Power gave ASI Progressive, which is a part of Progessive Group of Insurance companies, a score of 797 out of 1,000 for overall customer satisfaction. This was lower than the average score of 823.

On Consumer Affairs, Progressive's home insurance has four out of five stars based on over 400 ratings. According to the reviews, some have complained about a variety of issues. However, some were happy about the company's response time.

Home insurance coverages

Coverages may vary depending on which provider you choose, but you'll find a variety of standard coverages when you go through Progressive. A standard homeowners policy covers damages to your house and attachments, your personal belongings, lawsuits, temporary living expenses during home repairs and medical bills if someone else is hurt on your property.

You can also add water back-up coverage, which covers water damage from backed-up sump pumps and sewer systems, as well as personal injury coverage. Personal injury covers legal fees and additional damages from certain lawsuits and situations, such as slander or libel lawsuits.

How much does Progressive's home insurance cost?

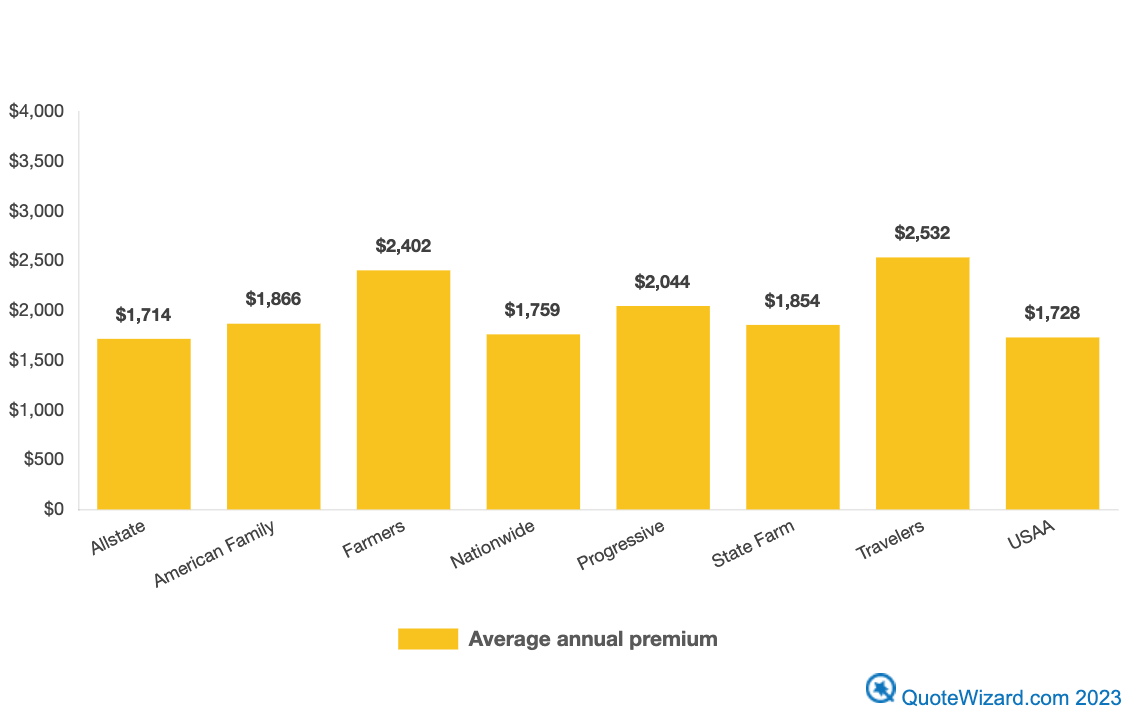

Progressive has a slightly higher average rate for home insurance. Progressive has an average annual rate of $2,044, which is higher than the U.S. average of $1,735.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

Homeowners insurance discounts

Progressive offers homeowners insurance discounts and extra ways to save on your policy's cost.

- Bundle home and auto: if you bundle your home and auto policies with Progressive, you can save an average of 5%.

- Safety and alarm discounts: if you have alarms or certain safety features in your home, you may be able to get a home insurance discount.

- New purchase: if you're purchasing a new home, you may be able to earn a discount.

- Pay in full: you're eligible for a discount if you pay for your policy upfront for the whole year.

Renters Insurance

You can get renters insurance for less than $1 a day with Progressive, according to the company, which is the average premium cost for Prgressive. Like Progressive's home insurance, renters insurance coverages are provided by affiliated and third-party insurers.

Renters insurance coverages

Coverages may vary depending on which provider you choose, but here are the main coverages on a renters insurance policy.

| Coverages | What it covers |

|---|---|

|

Personal property |

This covers damages to your personal belongings, such as furniture and clothing. |

|

Medical payments |

If someone is injured in your rental, medical payments coverage may help pay for their medical bills. |

|

Loss of use |

If you're unable to live in your rental due to a covered loss, loss of use coverage may pay for hotel and food expenses. |

|

Personal liability |

Personal liability may cover you up to your policy limits or cover lawsuit costs if you're liable for injuries to another person or damage to their property. |

| Additional overages | What it covers |

|---|---|

|

Water back-up |

Covers damage to your belongings and the cost of water removal due to backed-up plumbing or sewer systems. |

|

Personal injury |

If you owe money due to slander or libel lawsuits, then personal injury coverage may pay for your legal fees and damages. |

Renters insurance discounts

Progressive offers renters insurance discounts and ways to save if you're eligible.

- Bundle renters and auto: if you bundle your renters and auto policies with Progressive, you can save an average of 3%.

- Secured or gated community: if you have to drive by a security guard or use a key or remote to enter a gated complex or community, then you may be able to get a discount.

- Pay in full: you're eligible for a discount if you pay for your policy upfront.

Methodology

The sample quotes used for this review are based on a 30-year-old single male driver with a 2012 Honda Accord LX. Unless otherwise stated, this driver has a clean driving record with no prior insurance. He drives an average of 13,500 miles annually.

Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary.

For home insurance, we collected quotes for a standard HO-3 homeowners insurance policy. We used the following coverages:

- $275,000 dwelling coverage

- $27,500 other structures

- $137,500 personal property

- $55,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible