GEICO Auto Insurance Review

GEICO is a popular choice for car insurance because it is available nationwide, offers a variety of discounts and has excellent customer service.

GEICO is available in all 50 states and the District of Columbia, so drivers across the country can get coverage. The company also offers a variety of discounts, including discounts for good drivers, students, military members and those who bundle their home and auto insurance. GEICO consistently receives high marks for customer service, too.

In addition, GEICO is a financially stable company with a strong track record. This makes it a reliable choice for drivers who are looking for peace of mind when it comes to their car insurance.

Overall, GEICO is a great choice for car insurance. It offers a variety of discounts, great customer service and around-the-clock access to support. If you're looking for a reliable car insurance company, GEICO is a good option to consider.

Pros

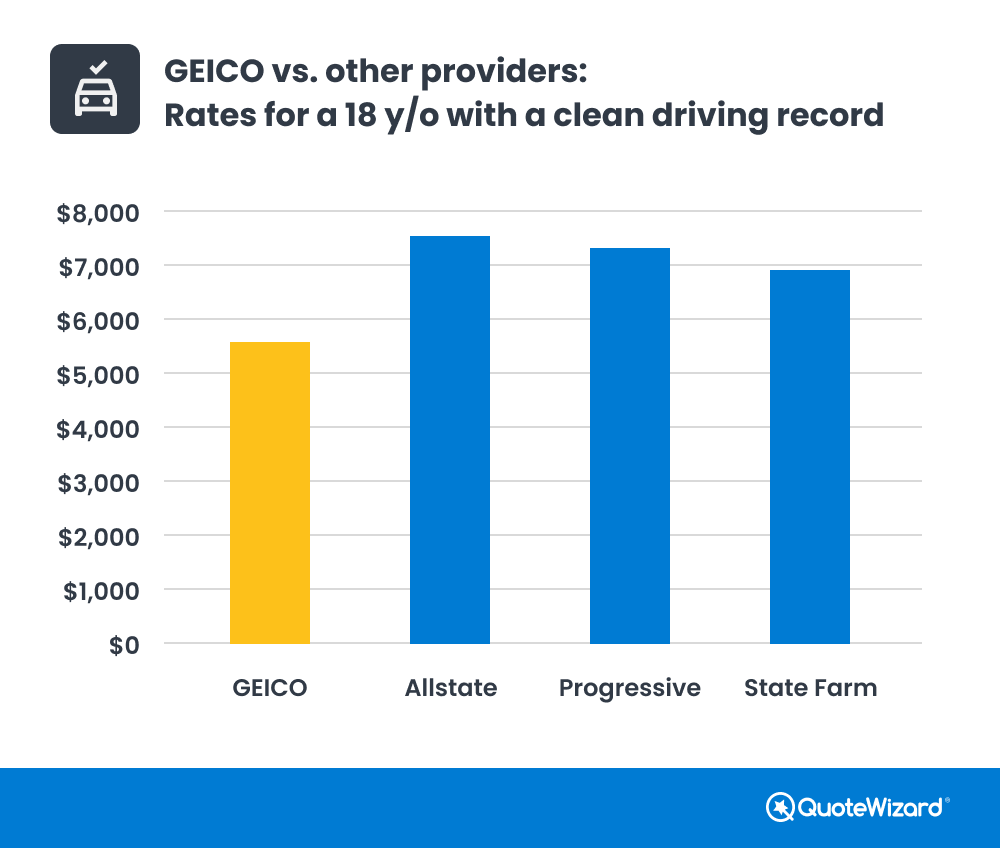

- Full-coverage rates for 18-year-olds are cheaper than the nationwide average.

- Good options for available discounts.

- High overall rating for customer service scores.

- Provides customer service 24 hours a day, 365 days a year.

Cons

- GEICO has the highest rates for drivers with a DUI.

- In our 2023 study, rates are slightly more expensive than the national average.

GEICO insurance ratings

In our study, we found that GEICO has excellent financial strength ratings from multiple different reporting agencies.

The company has received an AA+ rating from S&P, an Aa1 rating from Moody's and an A++ rating from AM Best. These ratings indicate that GEICO is a financially strong company that is well positioned to meet its financial obligations.

GEICO also has a good reputation for customer service. The company has a 4.3 out of 5 star rating from J.D. Power, a leading customer satisfaction research firm. This rating is based on surveys of GEICO customers.

Overall, GEICO is a financially strong company with a good reputation for customer service and adequate rates. These factors make GEICO a good choice for car insurance.

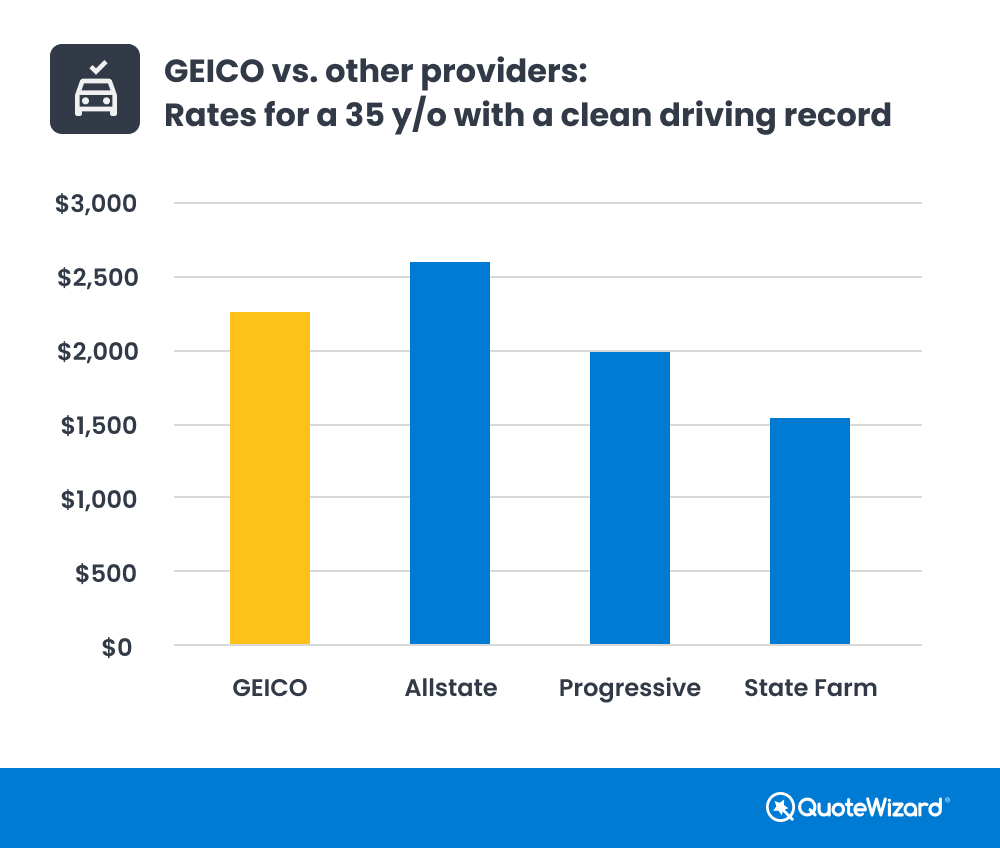

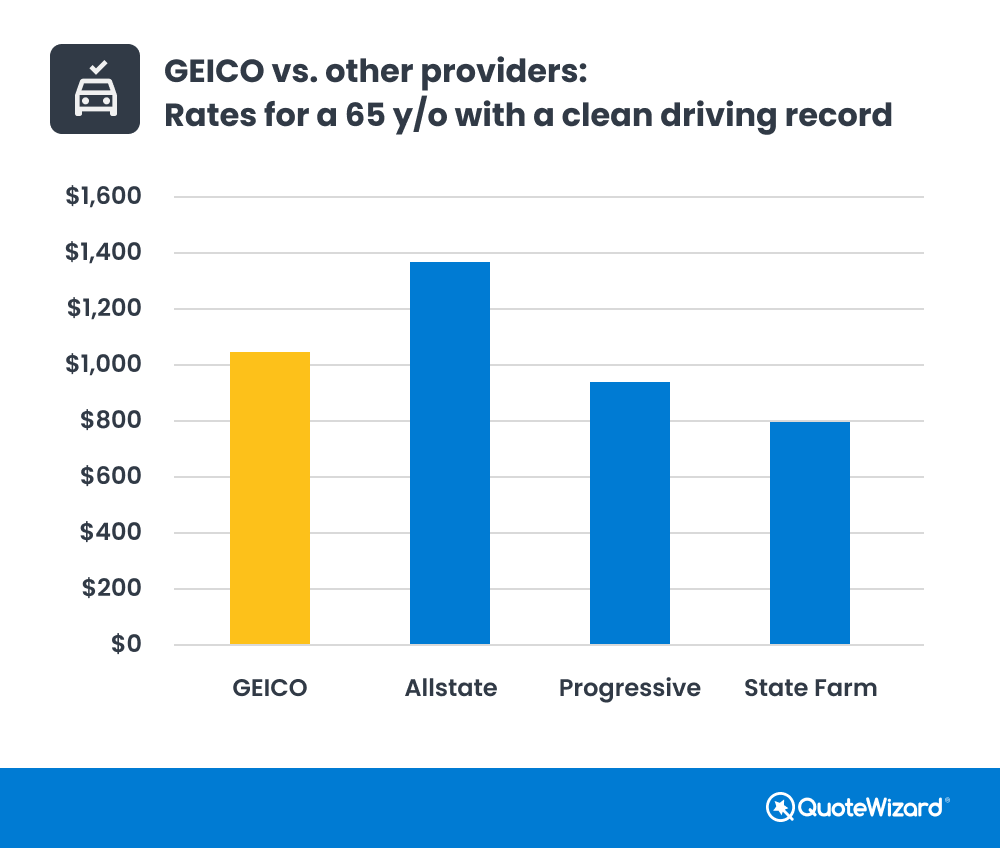

How GEICO compares to competitors for drivers with a clean record

How GEICO compares to competitors for drivers with a speeding ticket

Our study found that GEICO is a mid-range option for drivers with a speeding ticket on their records. These drivers can expect to pay slightly more than the national average of $1,185 a year. GEICO customers saw an average 27% increase in annual costs after a speeding ticket, according to our data.

| Company | Minimum coverage (yearly) |

|---|---|

| USAA | $623 |

| State Farm | $962 |

| American Family | $1,013 |

| Progressive | $1,185 |

| GEICO | $1,317 |

| Nationwide | $1,470 |

| Allstate | $1,505 |

| Travelers | $1,676 |

| Farmers | $1,912 |

| Rates are for minimum-coverage car insurance for a 35-year-old male with a speeding ticket. | |

How GEICO compares to competitors for drivers with a DUI

When it comes to having a DUI on your record, GEICO has the highest rates among its competitors. We found that GEICO customers saw an average price increase of 137% after a DUI. The national average for drivers with a DUI is $1,712 a year.

| Company | Minimum coverage (yearly) |

|---|---|

| USAA | $954 |

| Progressive | $1,177 |

| American Family | $1,296 |

| State Farm | $1,341 |

| Allstate | $1,853 |

| Travelers | $2,031 |

| Farmers | $2,184 |

| Nationwide | $2,206 |

| GEICO | $2,452 |

| Rates are for minimum-coverage car insurance for a 35-year-old male with a DUI. | |

How GEICO compares to competitors for drivers with an at-fault accident

GEICO is a higher-priced option for car insurance after an at-fault accident, based on our data. Prepare to pay an average of 66% more than you would with State Farm in this situation. On average, GEICO customers saw a 67% increase in their annual car insurance price after causing an accident. The national average for drivers with an at-fault accident is $1,430 a year.

| Company | Minimum coverage (yearly) |

|---|---|

| USAA | $732 |

| State Farm | $1,042 |

| Progressive | $1,409 |

| American Family | $1,515 |

| Nationwide | $1,536 |

| GEICO | $1,733 |

| Travelers | $1,888 |

| Allstate | $2,020 |

| Farmers | $2,099 |

| Rates are for minimum-coverage car insurance for a 35-year-old male with an at-fault accident. | |

States where Geico is the cheapest option for full-coverage

GEICO has the cheapest full-coverage insurance prices among its competitors in these states. Our Study analyzed the annual prices for a 35 year old driver with a clean record.

- California

- Florida

- Hawaii

- New Jersey

- Texas

States where GEICO is the cheapest option for minimum coverage

GEICO has the cheapest minimum-coverage insurance prices among its competitors in these states. We analyzed annual prices for a 35-year-old driver with a clean record.

- Arkansas

- Florida

- Hawaii

- New Jersey

- Texas

- Wyoming

GEICO available auto insurance discounts

GEICO offers a wide variety of discounts to its customers, with potential savings that can range from a few dollars to hundreds of dollars per year. The specific discounts that are available to a customer will vary depending on various factors. Discounts include:

| Discount name | Potential savings |

|---|---|

| Multi-Policy | Varies |

| Multi-Vehicle | 25% |

| Emergency Deployment | 25% |

| Federal Employee (Eagle) | 12% |

| Membership & Employee | Varies |

| Military | 15% |

| Defensive Driving | Varies |

| Driver's Educational Course | Varies |

| Good Student | 15% |

| Good Driver | 22% (Five Years Accident-Free) |

| Seat Belt Use | Varies |

| Air Bag | 23% |

| Anti-Lock Brakes | 5% |

| Anti-Theft System | 23% |

| Daytime Running Lights | 3% |

| New Vehicle Discount | 15% |

GEICO Home Insurance Review

Although GEICO lets customers purchase home insurance on its website, the coverage is serviced by one of its partners. That means coverage comes from another company. For home insurance, GEICO works with AIG, Assurant, Chubb, Hartford, Liberty Mutual, Travelers, Wellington Risk Insurance Agency and more to provide coverage. You can get a quote directly from GEICO's website. They also provide a personal property calculator to help you determine how much coverage you need.

If you have auto insurance or another type of insurance with GEICO, buying homeowners insurance through GEICO could save you money thanks to the company's bundling discount.

Pros

- Because GEICO gives you quotes from multiple providers, you'll be matched with an insurer that fits your price range and your needs.

- If you already have auto insurance with GEICO, you could save money by getting home insurance from GEICO, too.

Cons

- You won't be able to manage your homeowners insurance policy through GEICO

- Since you don't know what company you'll match with before getting a quote, you also won't be able to compare companies prior to getting a quote.

Homeowners insurance coverages

Your coverages may vary depending on which provider you match with through GEICO. The same is true of optional coverages. A common optional coverage is extra coverage for jewelry, artwork and antiques. Sump pump and water backup coverage might be offered by providers, too. Common coverages found in a standard home insurance policy include:

| Coverage | What it covers |

|---|---|

| Dwelling | Damage to your house |

| Other structures | Any permanent structures on your property if they are damaged by a covered peril |

| Personal property | Your belongings if they are damaged or stolen |

| Personal liability | Costs if you are sued for someone's injuries or property damage |

| Medical payments to others | Medical expenses if a guest is injured on your property |

| Loss of use | Living expenses if you temporarily cannot stay in your home |

Homeowners insurance discounts

The provider you match with determines which discounts you can access. If you have auto insurance with GEICO, though, you can take advantage of its multi-policy discount. Here are common discounts you can find at most insurance companies.

- Home security systems: If you have alarm systems in your home, you may be eligible for a discount.

- Smoke detector alarms or fire extinguishers: If you have smoke detector alarms and fire extinguishers, you could save money on your homeowners insurance.

- Claims-free: You might earn a discount on your policy if you haven't submitted a home insurance claim within a certain time period.

How much does GEICO's home insurance cost?

Rates may differ depending on which coverages you choose. GEICO's partners have different rates for different coverages, which is why we recommend comparing quotes.

| Average annual rate | Company |

|---|---|

| Chubb | $1,615 |

| Travelers | $2,273 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

The nationwide average for home insurance is $1,903 per year. If you qualify for only a few discounts with Travelers, your rate might be on the high side.

Bottom line for GEICO's home insurance

Since GEICO doesn't underwrite home insurance, we reviewed some of the companies that partner with GEICO.

Chubb: Chubb offers affordable home insurance rates. If you're looking for more protection, Chubb's Masterpiece Coverage offers some unique coverages. Replacement cost coverage is one example. It replaces damaged or destroyed items based on the amount it costs to replace them today.

QuoteWizard rating: 4.3 out of 5

Travelers: Travelers home insurance tends to be more expensive than competitors. Its average annual premium is higher than the national average of $1,903, too.

If you're looking for additional coverages, though, Travelers may be a good option. Travelers offers an optional coverage that covers more perils than a standard policy. Travelers also offers contents replacement cost coverage. This covers your personal property based on replacement cost at the time of damage.

QuoteWizard rating: 3.3 out of 5

What you need to know about GEICO's home insurance:

Since GEICO doesn't underwrite its home insurance policies, the third-party provider it matches you with will determine which coverages and discounts you can get.GEICO renters insurance review

You can buy renters insurance through GEICO. Like GEICO's home insurance, its renters insurance coverages are provided by third-party insurance companies. GEICO works with AIG, Assurant, Chubb, Hartford, Liberty Mutual, Travelers and more for renters insurance.

Pros

- GEICO will match you with a renters insurance company that best meets your needs.

- If you live in Florida, many well-known insurance companies do not provide online quotes. However, GEICO offers online quotes from Assurant.

Cons

- If you have auto insurance with GEICO, you'll have to manage your renters and auto insurance policies with different providers.

Renters insurance coverages

Similar to home insurance, your rental insurance coverages may vary depending on which provider you match with through GEICO. The coverages below are typically included in a standard renters insurance policy.

| Coverage | What it covers |

|---|---|

| Personal property | Damages up to a specific limit to your belongings if they need to be repaired or replaced due to certain perils |

| Liability | Costs if you are sued for someone else's injuries or property damage |

| Medical payments to others | Medical costs if a guest is injured on your property |

| Loss of use | Extra expenses if you're unable to live in your place for a period of time due to a covered loss |

Renters insurance discounts

Although renters insurance tends to be cheap, you can still take advantage of discounts. If you have auto insurance with GEICO, you may be eligible for a multi-policy discount. For more discounts, you will need to contact the third-party insurance company you're working with to see what discounts you can get. Many insurance companies offer the following discounts:

- If you live in a building with security staff or if you have a burglar alarm in your rental, you could earn a home security device discount.

- If you haven't had a claim for renters insurance for a certain time period, you may be eligible for a claims-free discount.

How much does GEICO's renters insurance cost?

Rates may differ depending on which coverages you choose. GEICO's partners have different rates for different coverages, which is why we recommend comparing quotes. Travelers, one of the companies GEICO works with, has an average annual premium of $212. This is slightly lower than the nationwide average of $214 a year.

Bottom line for GEICO's renters insurance

We reviewed renters insurance companies that GEICO works with to provide coverage for renters.

Travelers: Travelers offers moderate renters insurance rates. It has an average premium of $212 a year, which is close to the national average rate of $214. As it does with home insurance, Travelers offers some unique coverages for renters. Travelers' housing improvement coverage allows renters to apply 10% of their personal property coverage to cover improvements if damaged by a covered loss.

QuoteWizard rating: 2.9 out of 5

What you need to know about GEICO's renters insurance:

- Because GEICO doesn't underwrite its renters insurance policies, you may only want to look at GEICO's renters insurance if you already have another insurance policy with the company.

Methodology

For Auto insurance, Rates shown in this analysis are based on non-binding quotes for minimum-coverage and full-coverage car insurance obtained from Quadrant Information Services.

Unless otherwise noted, the typical driver is a 35-year-old male who drives a 2014 Honda LX for an average of 13,500 miles a year.

Full-coverage car insurance includes the following coverages, limits and deductibles:

- Bodily injury liability: $100,000 per person/$300,000 per year

- Property damage liability: $100,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

- In states where uninsured/underinsured motorist coverage and personal injury protection are required, the minimum limits required by law are included in the quoted policy.

For home insurance, we collected quotes for a standard HO-3 homeowners insurance policy. We used the following coverages:

- $275,000 dwelling coverage

- $27,500 other structures

- $137,500 personal property

- $55,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

For renters insurance, we collected online quotes from thousands of addresses in the U.S. We used the following coverages:

- $30,000 of personal property coverage

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

- Loss of use: 30%

QuoteWizard rated insurance companies based on their cost, discounts, coverages, financial strength, J.D. Power score, NAIC Complaint Index, and website experience. We used a weighted rating for each of these categories and scored them out of five.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.