USAA and Armed Forces Insurance serve military home insurance customers with low rates and quality service. Progressive has the cheapest rates.

Expert Homeowners Insurance Advice

Expert advice about buying a homeowners insurance policy including what's covered, discounts, and when you're being overcharged

Flood insurance in Louisiana costs an average of $62 a month. We can help you understand what it costs and covers.

Getting affordable coverage for your home can give you peace of mind without breaking the bank.

Need insurance for a mobile or manufactured home in Texas? Start shopping with quotes from Foremost, State Farm and American Modern.

The average cost of flood insurance in Texas through the National Flood Insurance Program (NFIP) is $704 per year.

Cypress has the cheapest condo insurance in Florida. Homeowners Choice, Kin and Citizens are also good options.

The average cost of flood insurance in Florida is $716 a year, which is $135 less than the national average. Find out how much you can save when comparing quotes.

The average cost of flood insurance through the NFIP is $851 per year, but the amount you pay depends on your location.

If you live in California, floods are a major threat. Learn here how flood insurance can help and if you need it.

Our study of the best homeowners insurance companies can help you find the right coverage for you at an affordable price.

If you have a mobile home built before 1976, getting it insured can be difficult. This guide can help you get your older mobile home covered.

Learn why homeowners can’t rely on a standard home insurance policy to protect their property.

Are you trying to figure out insurance for a mobile home in Florida? We'll explain what it does and how to get it.

Not having the right homeowners insurance can be costly. Here’s how to avoid the most common insurance mistakes homeowners make.

If you’re buying a home for the first time, here’s everything you need to know about getting homeowners insurance.

Homeowners insurance only covers basement floods under certain circumstances. Additional insurance options are available for extra protection.

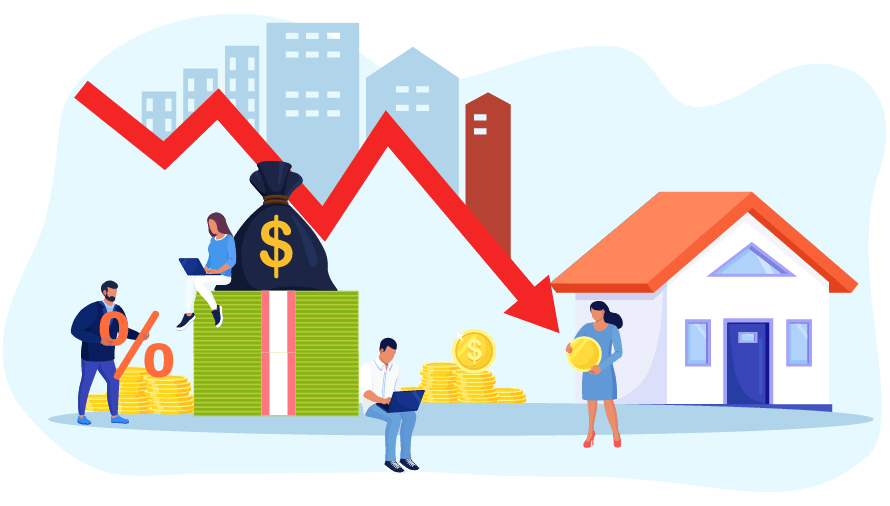

Homeowners insurance can be a costly investment. There are steps you can take, however, that may help your budget.

Seniors have special needs for their home insurance. This guide will help you understand how to get your best coverage.

Finding the right mobile home insurance can be difficult. Here's a look at the best insurance companies for mobile and manufactured homes.

If you're looking for flood insurance, we can help you learn more about what different flood insurance companies offer.

If you're a Florida homeowner, you may need separate windstorm insurance. We'll explain how it works.

Looking to get insurance for your mobile or manufactured home in Louisiana? We'll explain what you need for the best coverage.

Homeowners insurance varies by home types and coverage levels. Here’s how to find the right type of policy for you.

If you own a pit bull, it could mean some home insurance challenges for you. We'll help you find the coverage you need.

Standard home insurance doesn’t provide much coverage for short-term rentals. Here's how you can protect your property.

Discover key details about the best mobile home insurance companies in California and how to get the cheapest rate.

Alabama has the fifth-largest number of mobile homes in the U.S. If you're one of those owners, we can help you find the best policy.

Condo owners need different insurance than owners of a house. We'll help you understand how to get the best policy.

Standard home insurance for sewer messes is extremely limited, but a couple of inexpensive riders can fill the gaps.

Whether you move to a larger or smaller house, relocate to a new area, or are just unsatisfied with your current premium, you’ll likely need to review your homeowners insurance coverage.

A house left vacant for extended periods is a high insurance risk. We'll explain how to insure a vacant or unoccupied home.

NFIP and private flood insurance offer different cost and coverage options. Read on to learn which is best for you.

If you’re struggling to insure a high-risk home, a FAIR plan may help. Here’s how a FAIR plan works.

Home insurance covers one of the biggest investments you’ll ever have. We’ll help you find the right amount of coverage.

Condos and co-ops have different insurance needs than houses. Getting the right insurance means knowing the difference.

An inspection isn’t always necessary before insuring a home. This guide can teach you when you do and don’t need one.

Flood insurance in Houston costs an average of $678 a month. We will explain flood insurance and how to buy it.

Home repair insurance covers systems and appliances for reasons home insurance excludes. We'll explain more here.

Whether your home insurance will cover your leak depends on how the leak was caused. Read on to see if your home insurer will repair or replace your roof after a leak.

There are many reasons you might be paying too much for homeowners insurance. We can help you cut your insurance costs.

Homeowners insurance does not automatically cover sinkholes. Here's how to protect against this hidden threat.

Home appliance insurance covers some blind spots home insurance doesn’t. We’ll help you find the right home warranty.

If you live in an area with a history of mining operations, mine subsidence can be a threat. Keep reading to find out what mine subsidence means for your home insurance needs.

What’s an act of God, and does insurance cover it? This article helps clarify what it means and whether it’s covered.

A septic tank backup can cause expensive damage to your home. Learn here which sewage issues are and aren’t covered.

Depreciation can take a chunk out of a home insurance claim. Learn here how recoverable depreciation can work for you.

Home insurance and home warranties cover different parts of your home. Find out what they do and whether you need them.

Home insurance has a low coverage limit for jewelry. Learn what your best insurance options are to cover your bling.

Homeowners insurance protects you and your home, while mortgage insurance protects lenders from borrower default.

A CLUE report provides vital history of a home's insurance claims that is valuable to both homeowners and insurers.

If flooding is a risk to your home, you need the right flood insurance. Learn here what flood policy is best for you.

There are some problems that home insurance doesn’t cover. We can help you learn what isn’t covered and why.

Home insurance covers many dangers to your roof. This will depend on your roof’s age, condition and material quality.