Successfully completing a defensive driving course can help you in a number of ways. It can help you become a better driver — obviously. It can help you get a ticket or citation dismissed. It can help you get points removed from your license. And it can help you save money on car insurance.

How much money can you save on car insurance after finishing a defensive driving course or class? It depends on several factors, including where you buy coverage, but it’s possible to shave as much as 20% off your premium thanks to one of these classes.

We’ll tell you more about how defensive driving classes can cut your auto insurance costs in this article. You’ll also learn:

- Is a defensive driving course worth the money?

- Do you qualify for a defensive driving course discount?

- Which car insurance companies offer defensive driving course discounts?

- Which companies offer defensive driving courses?

- Are classroom or online defensive driving courses better?

What is defensive driving?

Defensive driving is a form of driver education that goes beyond the basic rules of the road. Standard drivers education programs teach traffic code and the mechanics of driving. Defensive driving courses, however, emphasize skills that help drivers avoid danger and accidents. These courses educate drivers on collision prevention techniques while encouraging courtesy and cooperation on the road.

"The defensive course will focus more on anticipating and reactions to situations," said Judy Ann Lunblad, the owner and operator at Ann's Driving School. "A regular class would typically include more rules and regulations."

Evidence suggests that defensive driving courses do just what Lunblad said they’re supposed to do, which is help participants become better drivers. For example, the Colorado State Patrol conducted a study on 1,000 defensive driving grads and found that 89% believed they were safer drivers because of the class.

Beyond that, defensive driving classes can also help you with:

- Ticket dismissal.

- Removing license points.

- Lowering car insurance premiums.

Defensive driving courses are taught online, in a classroom or behind the wheel. These courses are generally affordable, but are they a good investment? Keep reading to find out.

Are defensive driving courses worth the money?

The short answer is yes, defensive driving courses are worth the money.

Defensive driving courses give drivers a new perspective on viewing the road. They help drivers identify dangerous situations before they unfold. Defensive drivers can determine and mitigate risky behavior from other drivers. To put it plainly, defensive driving courses can save lives.

Defensive driving courses can help you save money, too. Specifically, they can help you save money on car insurance. Most car insurance companies offer discounts to customers who complete a defensive driving course. Many states legally require defensive driver discounts. If you have tickets or accidents on your driving record, a defensive driving course can mitigate the insurance rate increases that often accompany these infractions.

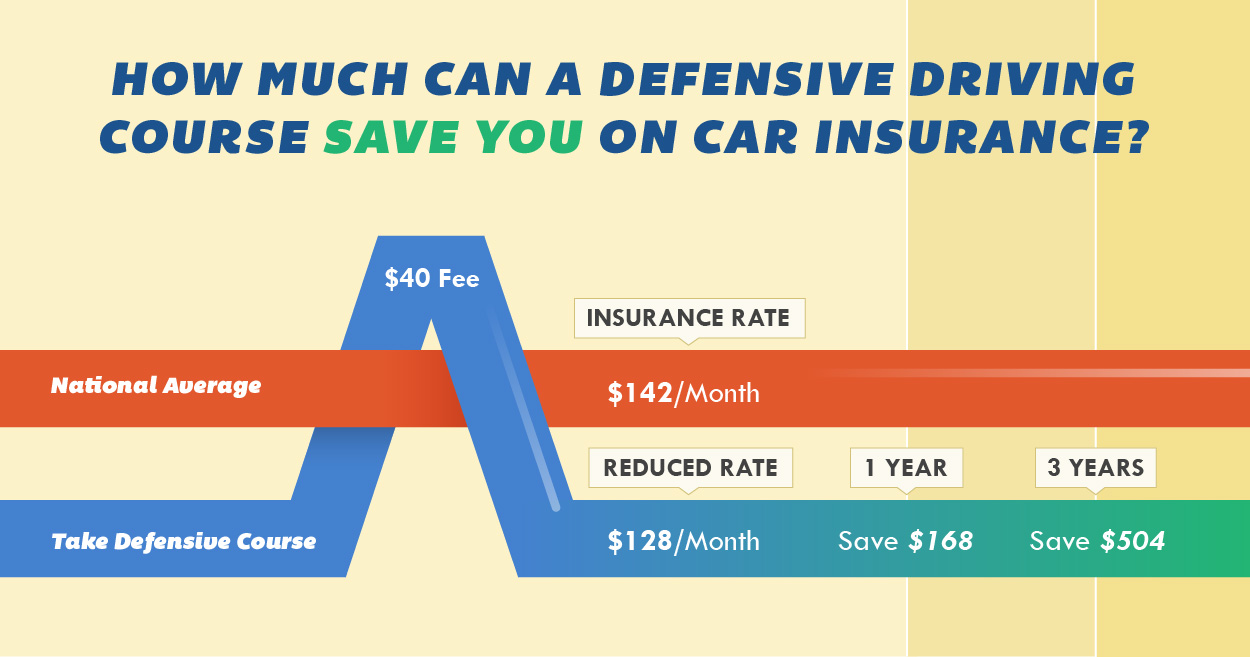

Signing up for and completing a defensive driving course usually pays for itself through insurance discounts. Consider this:

- Defensive driving courses range in price from $15 to $100. Most online courses cost between $20 and $40.

- Completing an approved defensive driving course typically results in a car insurance discount that lasts for three years.

- Discounts for defensive driving courses vary from 5% to 20%. Most insurance companies offer defensive driving discounts of about 10%.

According to our data, the national average car insurance rate is $105 a month. Let's pretend you enroll in a defensive driving course for $40. Once you complete the course, your insurance company gives you a 10% rate discount.

With the 10% discount, your monthly premium shrinks by over $14. You now pay about $128 per month for car insurance, if you’re like the typical American. After one year, you would save almost $170 thanks to a $40 defensive driving course. "The discounts keep running for three to five years, which is where the real savings are," said Devin Engelmann of Secord Insurance. In just three years, you would save over $500.

If you lower the discount to 5% and raise the cost of the defensive driving course to $100, you still come out ahead. You save over $80 a year or about $250 over a three-year period for the cost of a $100 driving course. And remember, most defensive driving courses cost less than $100.

See how a defensive driving course can save you money on car insurance.

Even without a discount, defensive driving courses remain a great investment. According to Improv Traffic School, drivers who complete a defensive driving course can lower their fatality rate by 50%.

Now that you're aware of the defensive driving savings you can earn, let's discuss whether you're eligible for discounts.

Do I qualify for a defensive driving course discount?

Many car insurance companies reward a defensive driving certification with a premium discount. Whether you qualify for a defensive driving discount often depends on where you bought your insurance coverage, where you live, your driving record, your age and more.

Insurance provider

While most insurers give defensive driving course discounts, it's not always the case. Check with your insurance company to be sure.

State

Even if your insurance company does offer a defensive driving discount, it usually varies by state. Discounts available in California may not be available in Georgia, for example. Some states legally require insurance providers to offer discounts for completing a defensive driving course.

Course

Not all defensive driving courses are equal. You can complete some courses entirely online, while others require in-person or even behind-the-wheel classes.

Insurance companies usually only accept certification from official schools. If you sign up for a defensive driving course, make sure it's from a reputable organization. Again, the best course type depends on each insurance company's requirements.

Driving record

Most insurance companies only give defensive driving discounts to customers with good driving records. If you have recent at-fault accidents or moving violations on your record, you may not qualify for the discount. Similarly, if you're taking a court-mandated defensive driving course, most insurers won't offer you a discount.

Age

Many defensive driving discounts are available only to drivers over the age of 55 or under the age of 25. Insurance companies consider these two age groups to be more at-risk drivers than others.

What insurance companies offer defensive driving discounts?

Allstate, GEICO, State Farm and USAA are among the auto insurance companies that offer defensive driving discounts.

Allstate

Drivers ages 55 and older can receive discounts as high as 10% after completing a defensive driving course. Allstate requires the driving course length to be six hours or more. Drivers must have no at-fault claims or violations to qualify for the full discount.

Young drivers can also net discounts through teenSMART, a computer-based driver education program. Allstate drivers in 42 states are eligible for teenSMART discounts. The program advertises that teens who complete it have up to 30% fewer collisions than those who do not. TeenSMART is a third-party program, and Allstate is one of their insurance partners.

American Family Insurance

American Family policyholders who complete defensive driving courses earn decent discounts. Drivers in participating states can earn a 5% to 10% break on their premiums. However, only drivers ages 55 and up can qualify for the defensive driver discount through AmFam.

Farmers

Farmers’ defensive driving discount is an option for senior citizens. Drivers must be 65 or older — 55 in some states — to earn the discount. Farmers requires courses to be DMV approved.

GEICO

GEICO's lengthy list of discounts includes one for policyholders who complete defensive driving courses. This discount is available in 45 states, but stipulations vary state by state:

- In most states, drivers must be at least 50 years old to qualify for the discount.

- Most drivers receive a 10% rate reduction after completing the course. California drivers receive the lowest rate breaks at 5%. Drivers in Arkansas, Delaware and New Jersey, on the other hand, can qualify for discounts up to 15%. New Mexico drivers can benefit from a whopping 20% discount.

- GEICO drivers can complete online defensive driving courses through the National Safety Council or the American Safety Council. Both courses are available online, and they're standardized and affordable: prices range from $15 to $25. Some states may require drivers to complete an in-person course.

MetLife

If you have a car insurance policy with MetLife and you complete the National Safety Council's defensive driving course, you might qualify for a discount of between 5% and 10%. To be eligible, you need to be licensed for at least two years. You also need to receive a score of at least 80%. The course is $21.95, and most policyholders will receive discounts for three years. This discount is available to drivers in most states.

Nationwide

Nationwide customers ages 55 and older may qualify for a defensive driving discount. The insurer requires the defensive driving course to be DMV approved. The exact driving discount varies, but it's usually around 5%.

State Farm

Drivers under the age of 25 can enroll in State Farm's Steer Clear program. Steer Clear requires drivers to complete an educational course and sign a safe driving pledge. It can lead to a 15% reduction of insurance rates. This program is available to drivers with clean records in 45 states.

State Farm also offers a defensive driving course discount. Eligibility and courses vary considerably depending on where drivers live.

Travelers

Drivers aged 21 and under who complete a driver education program are eligible for Travelers’ driver training discount. The discount can reach as high as 8%.

USAA

Military personnel and family members who complete an approved defensive driving course are eligible for lower car insurance premiums through USAA. Discounts vary state by state, and some age restrictions apply.

Who offers defensive driving courses?

If you’re looking for a defensive driving course that might result in a car insurance rate decrease, consider the following schools and organizations:

National Safety Council

NSC is a national organization dedicated to safety. Founded in 1913, it has offered defensive driving courses since 1964. Its online defensive driving course, SafetyServe, helps drivers save on insurance premiums. Numerous insurance companies accept these courses for discounts, but the following carriers have exclusive partnerships with NSC:

- Amica

- GEICO

- MetLife

American Safety Council

Similar to the NSC, the American Safety Council offers safety training programs across a broad spectrum of fields. Their online-based traffic safety course is available in several states. Course cost ranges from $15 to $30, depending on your state. ASC asserts that their course has regulatory certification. The following insurance companies have partnered with ASC:

- 21st Century

- AAA

- GEICO

- Travelers

AARP

Designed for older drivers, AARP's Smart Driver course is available to anyone ages 50 and up. The course is available entirely online and requires about four hours to complete. The online course is $20 for AARP members and $25 for non-members. Course topics range from using medication and driving, preventing distracted driving and proper safety techniques.

AAA

Similar to AARP, AAA offers defensive driving courses specifically for senior drivers. You can take an online or classroom course depending on your state. The price varies from state to state. In New York, for example, AAA members pay $30 for the online course and $36 for the classroom course. Non-members pay $42 for either class.

TeenSMART

TeenSMART is an online driver safety program tailored to teach defensive driving to new drivers. They advertise that their program helps teens lower their collision rates by 30% to 70%. TeenSMART has discount partnerships with the following insurance companies:

- Allstate

- CSAA Insurance Group

- Central Insurance Companies

- Liberty Mutual

- Mapfre

- Mutual of Enumclaw

Other insurance companies may also offer defensive driving discounts to policyholders who complete the teenSMART program. Call your agent to find out if that’s true of your insurer.

Costing almost $120, teenSMART is one of the more expensive defensive driving courses around. However, it's also one of the only courses designed specifically for teen drivers. Since insurance for teen drivers is considerably more expensive than it is for any other age group, teenSMART may be a worthwhile investment for some.

Local driving schools

Thousands of businesses provide driving lessons in the U.S. Many of these schools teach defensive driving alongside driver's education and traffic school. If you decide to go this route, make sure you ask about certification. Without regulatory approval, you may not be eligible for any auto insurance discounts.

How do I pick the best defensive driving school?

There are numerous defensive driving schools and courses. Here’s how to pick the right one for you.

First, make sure any prospective defensive driving schools are fully certified in your state. Courses from schools with proper regulation are more likely to qualify for a car insurance discount. "We issue a course completion certificate for the student to use for insurance discounts," Lunblad said.

Some driving schools may offer courses in states in which they are not certified. "Check with the DMV to make sure it is an accredited school," Lunblad added. Otherwise, you may sign up for an unsanctioned course, meaning you miss out on potential insurance discounts and benefits.

"When choosing a course, one should ask questions about curriculum," said J.C. Fawcett, instructor and master examiner at Defensive Driving School. For classroom courses, he recommends physically checking them out. "Visiting the site in person and speaking with an instructor will also give a prospective student some idea of what they can expect.”

Which are better: classroom or online defensive driving courses?

You can complete a defensive driving course online or in person. Both cover the same material, but there are some differences between the two options. Use this information to decide which type of defensive driving course is better for you and your situation.

Pros and cons of online defensive driving courses

- You can complete the course in your spare time and from the comfort of your own home.

- Usually cheaper than classroom courses due to lower overhead.

- More flexibility.

- Not all online courses are approved and regulated.

- There's no instructor to answer any questions that pop up as you go through the course.

Pros and cons of classroom defensive driving courses

- Taught by certified instructors.

- Often only require a single afternoon or weekend of your time.

- Less flexibility.

- More likely to cover local traffic laws.

- May have better reputations, and may be more likely to be regulated, than online courses.

One defensive driving course format may suit you better than the other depending on your needs and learning habits.

References:

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided "as is" and "as available" for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site. You expressly agree that your use of this site is at your sole risk.